Russian LNG Exports to Europe Remain High

Russian LNG exports to Europe remained at very high levels in February at 3.6 million CBM, following a 13 month high in January of 4.1 million CBM. Last month, Belgium imported the largest amount of Russian LNG, accounting for 38% of imports to the EU, wh

Currently, there are no sanctions on Russian LNG imports. Despite this, there has been a strong push to source energy from other countries since the start of the conflict with Ukraine last year. Amidst the backdrop of an energy supply crunch, exports from Russia have remained relatively unchanged.

In the drive towards cleaner energy, the LNG sector has come out as the winner. Sentiment remains strong for this sector; although the record breaking seasonal high has now come to an end, LNG freight rates remain well above average and are currently up c.27.2% YoY, circulating around 76,000 USD/Day.

Values for this category continue to strengthen. In the Large LNG sector of 160,000 CBM, price assessments for 20YO vessels have firmed by as much as c.20.82% since January to USD 80.80 mil.

Russian LNG exports to Europe since January 2020.

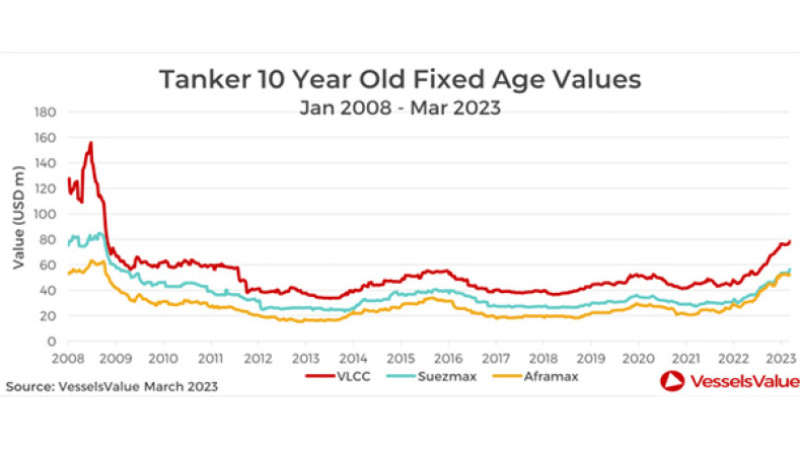

Crude Values Boom

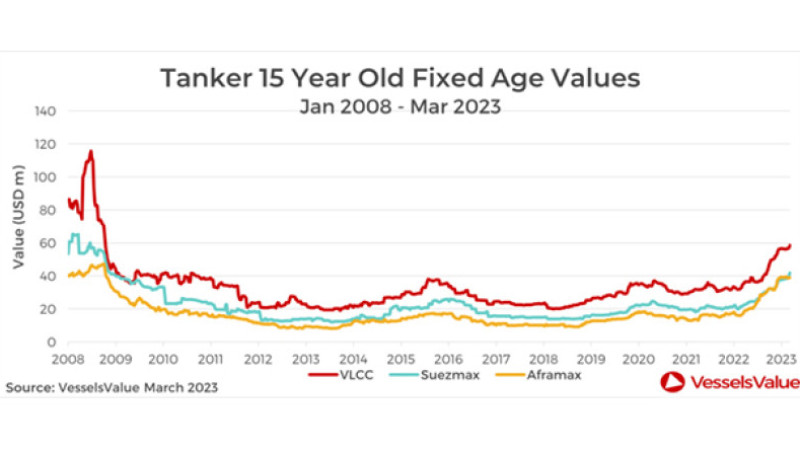

Crude values have strengthened across most sectors and age ranges since the start of the month. In the Suezmax sector, 15YO vessels have seen the most dramatic increase, up by c.3.98% to USD 41.77 mil, the highest levels since 2008. For VLCCs, 10YO vessels have risen in value the most this year and are also at a 15 year high of USD 78.30 mil. Values for Aframaxes have remained stable overall, with some slight increases for older tonnage.

The trend towards older tonnage continues, and the average age of vessels sold so far this year is 16 years of age. The majority of these sales are to undisclosed buyers, accounting for c.31.5%, followed by UAE based buyers at c.18%, and India ranking third at c.15%.

It is mainly Greek sellers who are offloading these elderly Tankers in order to take advantage of the high values, accounting for an overwhelming majority of sales at c42.5%. In contrast, the UAE ranks second with just c.10%.

Tanker values have increased due to bullish sentiment in both the spot and period sectors. As the number of Tankers entering the ‘dark fleet’ continues to grow, this has increased demand for the remainder of the trading fleet. VLCC TD3 TCE Middle East Gulf to China rates are currently around 90,000 USD/Day, up c.72% from the start of the month. Suezmax values have dipped since the peak at the end of last month but remain firm.

Notable sales include VLCCs Yufusan (311,400 DWT, Nov 2005, Mitsui Ichihara) that sold to Unknown Far Eastern buyers for USD 52 mil, VV value USD 51.36 mil. The Limnia (310,000 DWT, Oct 2009, Imabari) that sold to undisclosed buyers for USD 61.50 mil, VV value USD 62.23 mil. Additionally, the Kassos I (318,700 DWT, Jul 2007, Hyundai Samho HI) that sold to unknown Middle Eastern buyers for USD 60.00 mil, VV value USD 57.96 mil and the Suezmax, Lila Hong Kong (159,100 DWT, Nov 2003, Bohai Shipbuilding Heavy Industry Co) sold to undisclosed buyers for USD 31.00 mil (BWTS), VV Value USD 28.80 mil.

Crude Tanker values for 10 year old vessels are currently at levels last seen in 2008.

Crude Tanker values for 15 year old vessels are currently at levels last seen in 2008.

Handysizes Dominating Bulker S&P

Handysizes have led Bulker sale and purchase demand so far this year, accounting for c.33% of Bulker sales. China has been driving Handy purchases in 2023, accounting for c.22% of transactions, followed by Turkey with c.19% and Greece ranking third with c.11%.

In terms of values, Handys have seen a sharp increase MoM, with values for 10YO vessels up by c.6.34% to USD 15.76 mil. Sentiment of this sector is optimistic, and earnings have strengthened over the past month, jumping by c.54% MoM to almost 12,000 USD/Day.

Notable sales include the Interlink Priority (38,700 DWT, Sept 2015, Taizhou Kouan Shipbuilding) that sold to Tufton Oceanic for a benchmark price of USD 19.8 mil, VV value USD 17.57 mil.

LNG demolition

Large LNG carrier Adriatic Energy (125,814 CBM, Aug 1983, Mitsubishi HI) has been reported as sold for scrap, bringing the total to two demolitions for this sector so far this year. This figure already outpaces 2022 LNG demolition levels, where only one vessel was scrapped last year. This comes as historically high LNG charter rates, and a young fleet, spelled an inactive period for demolition.

Of the two vessels sent to the breakers yard in 2023 to date, both vessels are over thirty years old, indicating that only the oldest vessels are being scrapped. This reflects the market’s confidence in the LNG sector as an important transition fuel, especially in the move towards cleaner energy sources. This has fuelled the rapid growth in the price of LNG vessels over the last few years, along with the global energy crisis. Furthermore, a combination of sanctions and disruption to the Nordstream 2 pipeline led to loss of Russian LNG volumes to Europe. This resulted in high demand from European economies seeking to secure energy supplies in the run up to the Northern Hemisphere winter. Although seasonality led to a fall in earnings from the record breaking peak of over 465,000 USD/Day in November last year, freight rates remain well above average. Rates are currently at around 75,000 USD/Day, compared to 29,000 USD/Day this time last year.

Values for this sector have continued to rise in the first few months of this year, particularly for older vessels. For example, values of 25YO large LNG carriers of 130,000 CBM have increased by c.25% since the start of the year, from USD 44.32 mil to an eleven year high of USD 55.56 mil, giving owners plenty of reason to trade vessels for as long as possible.

VesselsValue data as of March 2023.

Rebecca Galanopoulos Jones