Venezuela’s Underground Resources Exceed a Theoretical Value of $20 Trillion

BİDER President Şenol Vatansever said that Venezuela’s vast oil and gas reserves struggle to turn into economic value due to high costs and infrastructure problems.

Theoretical Potential vs. Reality

President of the Global Informatics Association (BİDER), Şenol Vatansever, stated that Venezuela’s oil and natural gas reserves rank among the world’s largest underground resource potentials in terms of theoretical monetary value. However, he emphasized that turning this potential into real economic value remains limited due to high costs, long investment periods, and infrastructure deficiencies.

Oil Reserves and the Orinoco Belt

The country’s proven oil reserves are estimated at 303 billion barrels, most of which are concentrated in the Orinoco Oil Belt in the east. Based on current prices, the gross monetary value of these reserves is calculated at $19.3 trillion.

Production Challenges and Costs

Producing extra-heavy crude is technically and financially complex, requiring diluents, specialized extraction methods, and refinery investments. This adds $5–10 per barrel in extra costs, while technical production costs range between $12–18 per barrel. The overall cash break-even point is estimated at $35–45 per barrel, causing Venezuelan oil to trade at a discount compared to Brent crude.

Natural Gas Potential

Venezuela also holds 5.7 trillion cubic meters of proven natural gas reserves, with a gross value of about $800 billion. Yet, annual production remains below 30 billion cubic meters, limiting the economic conversion of these resources.

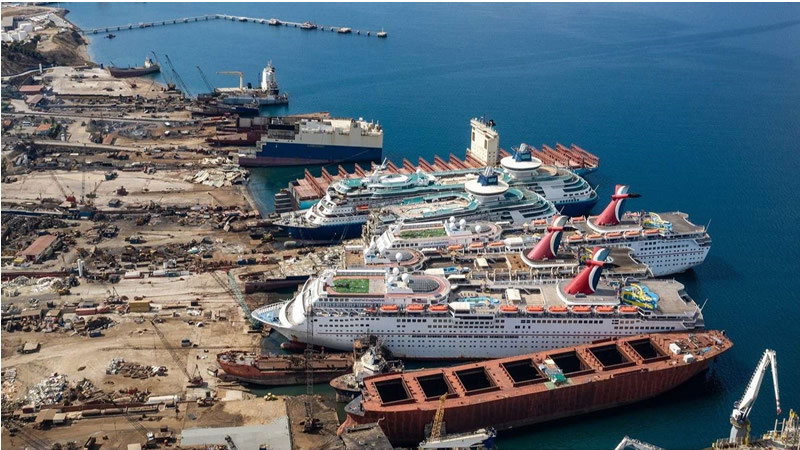

Decline in Production

Oil output has seen a long-term decline: from 3.4 million barrels per day in 1998, to 2.6 million in 2015, and down to 400,000 in 2020. Although recovery is underway, current production stands at 850,000–900,000 barrels per day. Experts attribute this drop to insufficient investment, lack of maintenance, and infrastructure problems.

Investment Needs and Returns

To achieve sustainable growth, Venezuela requires $15–20 billion in new investments over the next decade, covering pipelines, storage facilities, and export terminals. If realized, these projects could add 500,000 barrels per day in extra production. The payback period is estimated at 6–10 years, depending on oil price scenarios.

State Share and Public Revenues

International financial institutions note that the state’s share in oil projects typically ranges between 60–80%. Accordingly, of Venezuela’s $19.3 trillion gross oil value, $3.8–7.7 trillion could eventually translate into public revenues. With a population of 28 million, this equates to a theoretical underground wealth of $714,000 per capita, though the economically realizable portion is only $70,000–180,000.

Carbon Intensity Risks

The high carbon intensity of Orinoco’s extra-heavy crude poses long-term risks. Under global carbon pricing scenarios, this could add $10–20 per barrel in extra costs.

Conclusion

BİDER President Vatansever highlighted that Venezuela exemplifies the gap between underground wealth and economic prosperity: “Despite trillions of dollars in theoretical potential, converting this into economic value requires significant capital, long-term investment, advanced technology, and strong institutional capacity.”