Bulker S&P Activity Falls Sharply in Q1 2025

Due to market uncertainty, overall sale and purchase levels for Bulkers have fallen year on year, with a decrease of c.58% and just 77 reported this year to date, compared to 182 for the same period last year.

Rebecca Galanopoulos Jones

-Due to market uncertainty, overall sale and purchase levels for Bulkers have fallen year on year, with a decrease of c.58% and just 77 reported this year to date, compared to 182 for the same period last year. Since the US proposed fees to Chinese-built vessels entering US ports in February, sale and purchase levels for Chinese-built Bulkers has fallen by c.58% with just 62 transactions reported since February, compared to 146 for the same period last year.

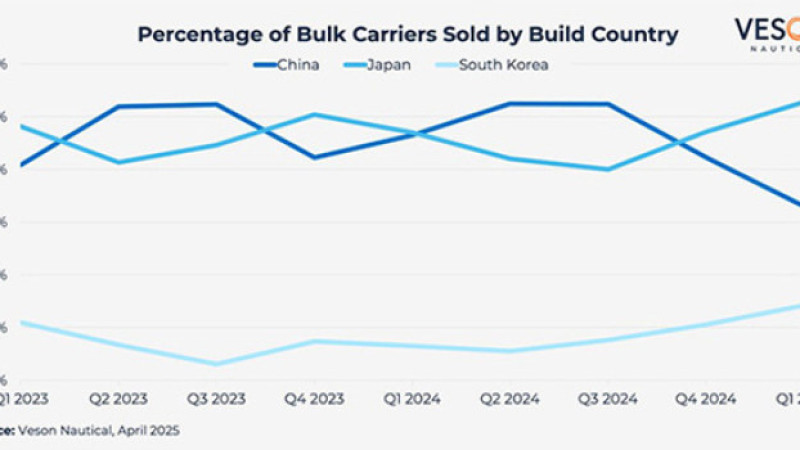

Sales for Bulkers built in China fell from c. 42% in Q4 2024 to c. 33% in Q1 2025, falling below Japan who ranked first, representing c. 53% of sales in the first quarter of this year. Meanwhile South Korea, who traditionally specialise in building other vessel types such as LNG vessels, unsurprisingly ranked third with a share of c.14%.

China is currently the top builder of Bulkers; end-of-year data from VesselsValue’s latest report shows that in 2024, Chinese yards received three quarters of all Bulker orders.

Values for Bulkers are down year-on-year across almost all sub sectors and size categories. For example, 15 YO Panamaxes of 80,000 DWT fell by c.21.99% from the same period last year from USD 18.46 mil to USD 14.4 mil.

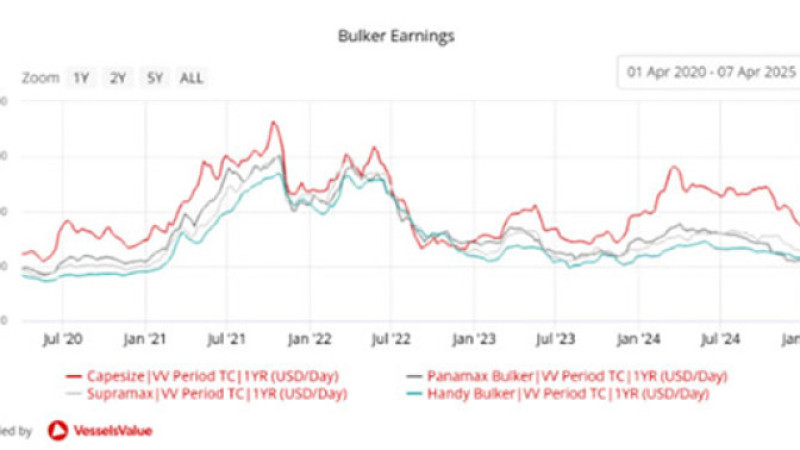

Although time charter earnings for Bulkers have picked up from the traditionally quiet Q1, rates are down across all sectors. Capesize one year TC earnings fell by approximately 18% year-on-year from 26,965 USD/Day at the start of April 2024 to 22,131 USD/Day at the start of April 2025, according to VesselValue’s Timeseries data.

Notable recent sales of Chinese-built vessels include the Kamsarmax BC Sea Marathon (81,900 DWT, Sep 2015, Qingdao Wuchuan) sold SS/DD Due to Modion Maritime Management for USD 18.4 mil, VV Value USD 16.69 mil. The Ultramax BC 134 (Hull) Nantong Xiangyu (63,600 DWT, Nov 2025, Nantong Xiangyu) sold to unknown Greek buyers for USD 35 mil, VV Value USD 34.51 mil and the Handy BC Lago Di Cancano (37,700 DWT, Jan 2014, Qingshan Shipyard) sold to undisclosed buyers for USD 14 mil, VV Value USD 14.41 mil.

Author: Rebecca Galanopoulos