20 Mayıs 2019 - Pazartesi

Quo Vadis or where do shipowners head at the Black Sea basin?

The area of the Black Sea together with Azov sea and the North entrance to Bosporus has been recognized as unique for shipping and trading for many centuries.

Yazar - Alex Tarazanov

Okuma Süresi: 17 dk.

Alex Tarazanov

marlin@atship.net -The area of the Black Sea together with Azov sea and the North entrance to Bosporus has been recognized as unique for shipping and trading for many centuries. Kevin Rawlinson at The Guardian reports that the Black Sea Maritime Archaeology Project (MAP) has discovered an Greek merchant vessel on the floor of the sea dating back to about 400 B.C., the oldest known intact shipwreck ever discovered.

Throughout the history of mankind civilization development at this area, different countries located on the shores of the Black Sea basin and/ or had entrance to the sea through local sea ports or by the rivers connected to the sea. Fig. 1 shows 388 known ancient ports and harbours in the Black Sea area. Out of this number, 165 places are mentioned as harbours by ancient authors.

Nowadays there six (6) countries who have a coastline on the Black sea i.e. Turkey, Bulgaria, Romania, Ukraine, Russian Federation and Georgia. It means that all these countries have a high percentage of shipping their goods by sea. Getting goods from one side of the country to the other by the sea is a big business.

There are several factors that are important in this business. The main ones are speed, cost and size. Trade raises demand on quantity of goods to be shipped daily, monthly and yearly. All these countries around Black sea have made the shipping one of the most developed and organized infrastructure. Numerous goods from their ports are shipped every day worldwide. Russian Federation takes a leading part in shipping of raw material and agricultural cargoes from its ports.

What makes it possible to keep shipping in this area on such a high level? Among many factors like economy, international trade, export and import there is one which should be taken into concideration. It is specific landscape of the bottom, shallow waters and currents in this area.

The vessels should be intergated with the ports unique aspects. Inland ports should be reachable and served on the same level as the sea coastal ports by the same vessels. To make this integration possible either by inland going sea ships with low draft or by river type vessels trading in waters with limited seaway conditions.

The best sollution to keep up with the quantity of shipped goods and meet the demands of loading ports is the river-sea type vessels. Such type has been developed and constructed at times of the USSR to cover all water ways inland and seas. Many of those vessels contructed and put into work are still present and trade, yet the development work on the new projects is still in progress especcially to improve the behaviour of river-sea ships in waves of larger hights by optimizing the ship’s form or design.

In the modern world the main factor is economical success. So, the integration of river-sea trade is a necessity. Next factor is safety in utilization inland and coastal areas. Combined navigation at sea ports and river ports requires combination of size, menoeuring and draft. River-sea type vessels combine all the stated requirements to succeed economically.

The USSR bureaus had created river-sea navigational vessels taking into concideration special aspects of area of operation and designing hulls of optimum strength in regard to the weather conditions. The rules, stated by the Soviet ship classification society, required ability to navigate in high waves and ice. As the result the river-sea type vessels with smaller drafts for a given capacity could have met the European ports standards.

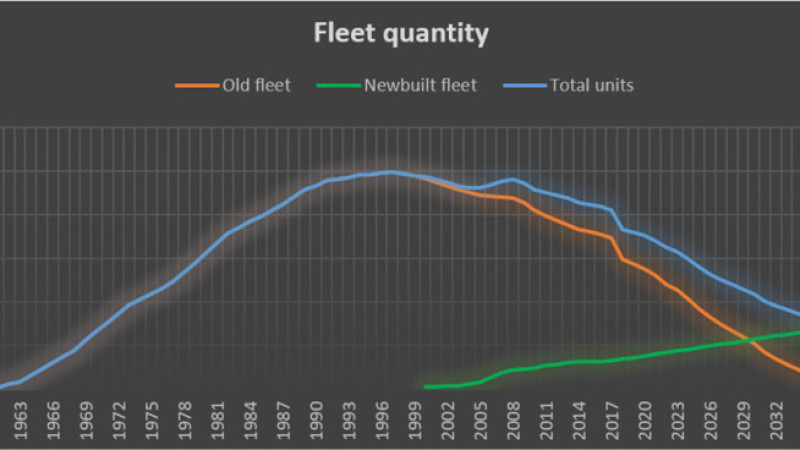

What is the present situation with the tonnage in the black sea basin? The main reason for the positive trends in the sea-river vessels type market is that, unlike the global maritime market, the number of combined type vessels is decreasing. Built for 30-35 years of operation, many of those vessels have been in operation 45 years or more. The old vessels built in the 60s-70s-80s are gradually being withdrawn from work due to the high running cost. The number of the old fleet decreases in progression and this process, of course, is irreversible.

The number of output fleet is greater than the number of newbuilt, as seen in the diagrams below. In general, the forecast for the number of fleet units in the market "River-Sea" type is as follows:

For the time between 2000 to 2017 yy there are 180 vessels have been built, which means 7 units per year. This figure is put to the calculations of the shipbuilding forecast, yet, is too optimistic as there was no ship built in 2015, only one river-sea dry cargo ship was put to work in 2016, in 2017 3 ships started at shipyards, another 8 can be put to work in the next 3-4 years.

Currently, the Russian government is pursuing an active policy to remove forcibly the old vessels from service, which will lead to a sharp decrease in the number of the old fleet involved in transportation in the Azov and Black Sea ports, as well as in the Caspian and internal river routes in the next few years. This in turn will lead to high demand in tonnage causing the growth of freight rates followed by the market requirements, and hence the current period is the most favorable for investment into the construction of the new combined "River-Sea" vessels.

Taking into account, the requirements of the ballast water convention that came into force, within maximum 4 years it is necessary to install expensive equipment for the purification of ballast water from microorganisms for all existing vessels. The cost of equipment is from $ 150,000, and the residual value of old ships when scrapping does not exceed $ 300 - 400,000, most shipowners in the old fleet will not carry out expensive upgrades and take vessels out of service.

Let’s point out, that the average loading capacity of the decommissioned fleet is 3000 tons / vessel, while the new vessels typically have a carrying capacity of about 5,000 tons/vessel.

In the course of 20 years, tonnage reduction will be approximately of 2'000'000 ton, upon the current dynamics of the construction of new vessels.

Market review or the role of the combined vessels on the market at the Black Sea region. the combined "River-Sea" type remains the most attractive and financially successful in comparison with others affected by the global financial crisis and the excess of tonnage supply. Such a vessel meets requirements having a sufficiently strong hull and machinery and a set of rescue equipment for sailing on the high seas’ conditions; this vessel has the draft and dimension suitable for efficient loading in shallow-water ports, river locks with restrictions in bridges’ height or restrictions in maneuvering. The major factor is the commercial operation of such a vessel in transportation of various goods. The numerous River fleet can operate only on the internal Eurasian rivers without going to sea and the Coasters can enter deep-water rivers only such as the Danube, the Elbe, the Wesser estuary, while the “River-sea” type in not limited by these restrictions but covers all the areas.

Mainly, the River-Sea type vessels with cargo capacities from 1000 to 7000 tons. The limitations are caused by the size of the shipping locks to a maximum of 140 meters in length and 16 in width, with a draft on canals of about 3.6 meters under normal conditions.

Geographically work/trade of such vessels spreads greatly from the Northern and Baltic seas to the Mediterranean region and in the basins of the Azov, Black and Caspian seas. From the river ports of Russia (Volga and Don river) and Ukraine (Dnieper and Danube) cargo is delivered to numerous ports of northern Africa and southern Europe, from the northern ports on Neva River to Germany, France, the Great Britain.

Due to structural and navigation restrictions, and also according to commercial expediency, most ships are operated on short voyages. For example, there are shipments of grain, coal, logs, scrap, minerals by sea from ports in Russia or Ukraine to Turkey, Greece, the Eastern Mediterranean and/or the Adriatic Sea; by the river ports of Russia to the northern Iran at the Caspian Sea.

However, there is also a demand for long voyages, for example, with grain sub-products from the ports of the Azov Sea to the UK or from the river ports of Russia to Northern Africa.

A large number of high cost project cargoes for the oil-extraction industry is delivered from Europe along the internal river routes of Russia to the Caspian Sea. Another advantage of the "River-Sea" type vessels is ice class availability, which allows them to work all year through from the ports getting under ice in winter.

Recently the increased harvest of grain and exports from Russia has led to increase in demand on operations of the ship-to-ship transshipment, where cargo is exported from the river ports to the Black Sea by small vessels with raid handling of floating cranes for large tonnage of Handy and Panamax for further delivery to the countries of the Persian Gulf, Southeast Asia, where there is demand.

Fluctuations in freight rates on the river-sea type vessels market are seasonal and depend on the export of grain products from Russia and Ukraine. The increase in exports leads to an increase in demand for ships and a rise in rates as the basis for the profit of transportation and the payback of the fleet, and vice versa - a decrease in the volume of shipments in winter reduces profitability. The dynamic changes are presented in diagrams.

The transportation market and the level of freight rates are regulated by supply and demand and are directly dependent on international trade in resources and goods requiring transport by sea.

So in the period from July to December there are intensive shipments of grain for export from Russia and Ukraine, including shallow ports. The demand for ships in such a period is high, as well as freight rates. In the winter, trading through ice in the Azov Sea requires ships with an ice class, which is available only on 40% of the fleet causing high demand on vessels in this area. The spring period is usually defined by low freight rates.

There are currently 950 vessels operating on the River-Sea market, 180 of which were built between 2000 and 2017, while among the remaining - 600 vessels older than 30 years old and in the next 5 years will be out of use. The working tonnage by 2025 will be in total slightly more than half in the volume of the current tonnage. Considering the continued increase in harvest in Russia and Ukraine and the volume of exports, the demand for tonnage in the "river-sea" segment will not only be stable but also grow steadily.

Looking to the future of shipping in this area. There is a steady situation in shipment from the ports of Black sea worldwide. The quantity of cargo will be stable with tendency to grow in near future. The limitation in vessels size caused by the construction of the bridge at Kerch straight makes it impossible to use panamax, supramax or any other big size vessels forcing to use river-sea type vessels only.

Analyzing all above mentioned aspects, criteria and demands, we tend to believe, that the active support should be given to the shipowners to improve the fleet of combined vessels, encouraging the potential investors and shipbuilders to replace old vessels. The new modern projects should be taken into construction with up-to-date technical, ecological and economical benefits.

Alex Tarazanov. Founder of “Marlin Denizcilik Teknik Danismanlik”, naval architect, expert in river-sea ships’ market with over 15 years of practice.

Yorumlar (0)