Tariffs and trade tensions dominate global shipping in first half of 2025

Veson Nautical’s half-year report says a turbulent first six months of 2025 has reverberated across the global shipping industry.

New US tariffs and escalating global trade tensions have reshaped vessel markets in the first half of 2025, curbing investment in some sectors while accelerating strategic orders in others, according to the Half-Year Market Report by Veson Nautical, a leading provider of maritime freight management solutions and data intelligence.

The report states that US trade policy changes hit vehicle carrier markets particularly hard, contributing to a 44% drop in charter rates for standard 6,500 CEU vessels and a complete halt in newbuild orders during the first six months of 2025. The liquefied petroleum gas (LPG) sector was also affected, with newly imposed tariffs between the US and China weighing on investor confidence and helping push sale and purchase (S&P) volumes down by 25% year-on-year (y-o-y).

Vehicle Carrier Charter Rates ($m/CEU)

The report adds that the container ship sector was indirectly impacted, as frontloading and rerouted supply chains prompted operators to accelerate newbuild orders despite persistent cost pressure.

“Geopolitical pressure is no longer a background factor; it’s shaping the way owners think about risk, timing and capital,” said Matt Freeman, Chief Market Analyst at Veson Nautical. “From regulation to rerouting, disruption is now part of the operating environment, and owners are recalibrating their strategies accordingly.”

Boxship sector still bullish

Container ship newbuilding surged, with orders up 288% y-o-y during the first six months of 2025. Owners moved quickly to secure tonnage amid ongoing diversions around the Cape of Good Hope and congestion at European ports. Despite global uncertainty, trade volumes rose by nearly 5%, and demand for mid-size capacity remained strong. Values for 15-year-old Feedermax vessels climbed by 16.5%, supported by limited availability and steady interest from major buyers.

Cooling sentiment in tankers

The tanker sector saw a marked pullback, with newbuilding orders down 74% y-o-y and S&P volumes falling by 31%. Softer earnings and regulatory uncertainty were key drivers. Medium Range 2 (MR2) product tankers were the exception, accounting for over a third of transactions as buyers capitalised on lower values. Typically sized between 45,000 and 55,000 DWT, MR2s are product tankers that typically ship gasoline, diesel, jet fuel and other refined products across regional and intercontinental routes. Values for 15-year-old units fell by 24%, drawing renewed interest in ageing but versatile tonnage.

Earnings pressure builds in the liquefied natural gas carrier sector

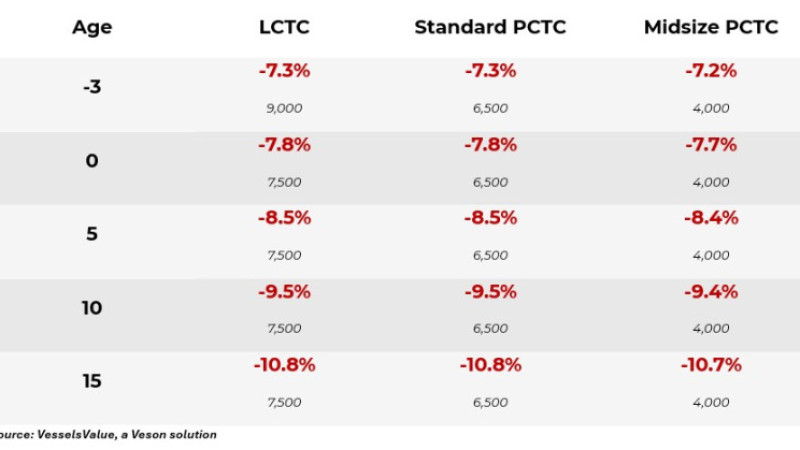

The liquefied natural gas (LNG) carrier sector came under sustained pressure during the first six months of 2025, with average time charter earnings for large vessels falling by 66% y-o-y. The decline was driven by continued fleet expansion outpacing demand growth, along with weaker seasonal fundamentals. As rates fell, demolition activity increased sharply, with seven vessels scrapped—a 250% rise on the same period in 2024. Older steam turbine vessels saw the steepest value declines, with 15-year-old units down by more than 8%. While demand for LNG is expected to rise in the coming years, the current tonnage surplus is likely to keep pressure on earnings through the rest of 2025.

Tariff drag hits the liquefied petroleum gas carrier sector

In the LPG carrier market, S&P activity slowed by 25% y-o-y, weighed down by trade policy uncertainty between the US and China. Newbuilding orders dropped by 80% compared with the same period last year. Most activity was concentrated at the very large and small ends of the fleet, with limited momentum in the midsize space. Values fell across the board, though long-term averages remain high by historical standards.

Mixed signals in the bulker sector

Market conditions were uneven across the bulker space. S&P volumes declined by 36% y-o-y, with buyers cautious amid softer sentiment in the smaller segments and mounting regulatory pressure. Capesize vessels stood out, with values rising nearly 6% on the back of strong Chinese iron ore demand and tight supply. Chinese and Greek buyers were the most active, though volumes were down overall. Newbuilding interest remained subdued due to high prices and extended delivery times, while demolition levels stayed low as many owners continued to trade older units.

“Capesize activity has held up well, but it’s not a broad-based recovery,” said Rebecca Galanopoulos, Senior Content Analyst at Veson Nautical. “Tight supply and steady demand out of China have helped lift values at the top end, but elsewhere the market is still contending with high asset prices, regulatory friction and a widening gap between modern and vintage tonnage.”