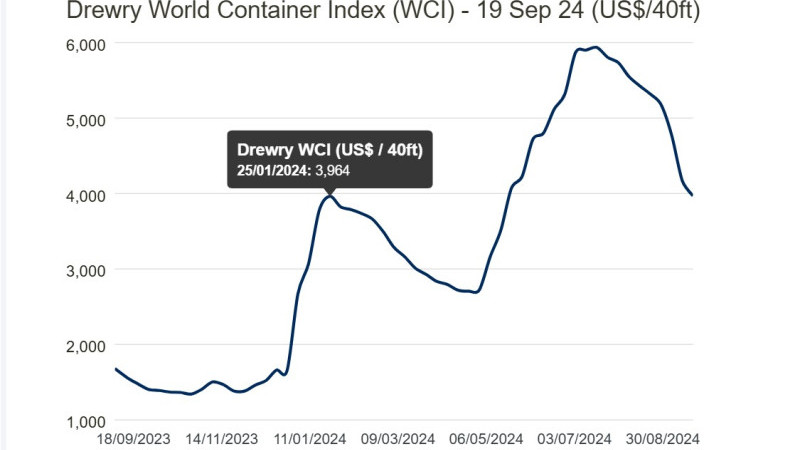

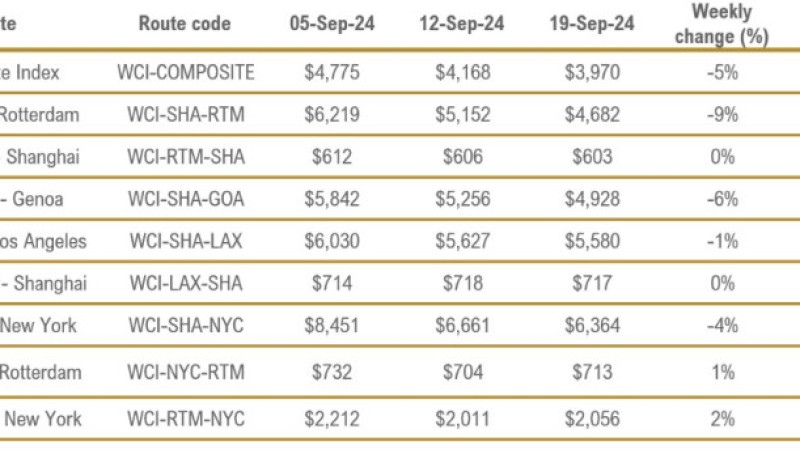

World Container Index - 19 Sep

Drewry’s World Container Index decreased 5% to $3,970 per 40ft container this week.

Source: Drewry World Container Index, Drewry Supply Chain Advisors

Our detailed assessment for Thursday, 19 September 2024

• The latest Drewry WCI composite index of $3,970 per 40ft container is 62% below the previous pandemic peak of $10,377 in September 2021, but it is 180% more than the average 2019 (pre-pandemic) rate of $1,420.

• The average composite index for the year-to-date is $4,124 per 40ft container, which is $1,302 higher than the 10-year average rate of $2,821 (inflated by the exceptional 2020-22 Covid period).

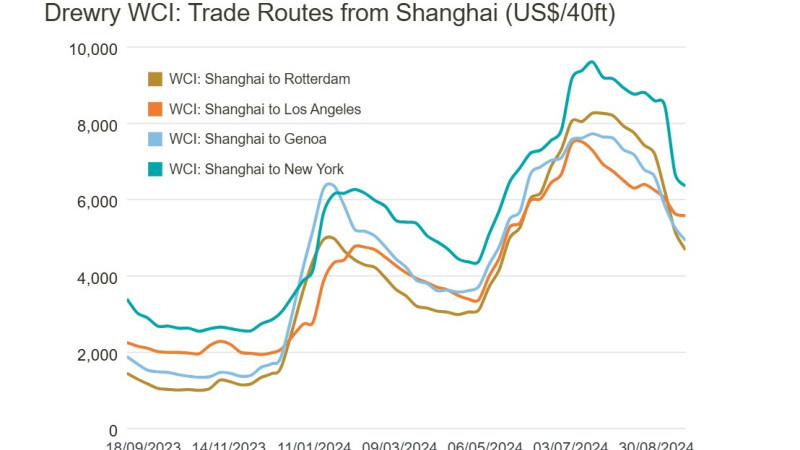

• Freight rates from Shanghai to Rotterdam plunged 9% or $470 to $4,682 per 40ft container. Similarly, rates from Shanghai to Genoa contracted 6% or $328 to $4,928 per feu. Likewise, rates from Shanghai to New York declined 4% or $297 to $6,364 per 40ft box. Also, spot rates from Shanghai to Los Angeles dropped 1% or $47 to $5,580 per 40ft container. Conversely, spot rates from Rotterdam to New York increased 2% or $45 to $2,056 per 40ft box. Likewise, spot rates from New York to Rotterdam inched up 1% or $9 to $713 per feu. While the looming ILA port strike casts a shadow, transpacific Eastbound freight rates have experienced a minor decline this week. However, weak demand is expected to drive further decreases in East-West spot rates in the coming weeks.

Spot freight rates by major route

Our assessment across eight major East-West trades:

Ocean spot market freight rates against 790 global port pairs

If you need spot market container freight rate information on other routes to those above, find out more about our Container Freight Rate Insight (CFRI) online service, which covers over 790 global port pairs (updated monthly).