Our aim is to keep premiums within national limits

In our year-end evaluation conversation with Ufuk Teker, General Manager of Türk P&I Insurance, we discussed both their 10 years in the sector and their future targets.

In our year-end evaluation conversation with Ufuk Teker, General Manager of Türk P&I Insurance, we discussed both their 10 years in the sector and their future targets. "Which classification society do Italian flagged ships work with in Italy, which classification societies do shipowners in Scandinavia choose? Countries subject classification societies and P&I clubs, which are important institutions for them, to positive discrimination. I hope that this institutional nationalism will reach the desired levels in Turkey as well," said Teker and underlined that their main objective in establishing the company was to keep the premiums within the national borders.

First of all, as Türk P&I Insurance, you celebrated your 10th anniversary in October. We wish you all the best and would like to start our conversation here. We would like to learn about the point Türk P&I Insurance has reached today, and we would like to know what factors have led you to this point, and how has this 10-year period been for you?

With your participation, we had the opportunity to celebrate both the 100th anniversary of our Republic and the 10th anniversary of our company. When our company was first established, our main goal was to gain expertise in P&I insurance in Turkey and to keep the premiums ceded abroad within national borders. This process went beyond establishing a company; it was necessary to create a team with technical competencies in management, operations, claims management, underwriting, loss prevention and survey services, and financial affairs management. Our first goal was to acquire the know-how on P&I. Today, I can easily say that we are one of the countries with recognized and well-known P&I companies. We are even recruiting new graduates to expand our team.

What problems did you face and how did you overcome these problems for this progress and development?

I can say that the name Turkish P&I Insurance is well established in our market today. In fact, we have become the most preferred brand in the Turkish shipowners' and ship operators' market due to the fact that we are the only local company in the sector in the P&I branch. When we first set out on this journey, we were confronted with decades-old habits and expectations of meeting service expectations at a much cheaper price. We had to overcome these habits both in the eyes of ship owners and ship operators as well as insurance intermediaries and brokers. However, I would like to point out that the process was of course not limited to this, and we also encountered the negative approaches of ship charterers and port states and even ship flags. Although I think we have overcome many problems at the point we have reached today, I must state that similar agendas are still continuing with many port and flag administrations and we are constantly meeting and developing.

I compare this process with the IACS process of Türk Loydu. Türk Loydu had lost its energy while trying to become an IACS member for decades, but could not provide service to shipowners because it was not IACS. With the approval process completed, a significant part of the road has been covered for Türk Loydu. Similar processes are also valid for Türk P&I. As targets are exceeded, new obstacles emerge. However, it is also a fact that our situation today and our ability to overcome problems have improved a lot compared to the past.

As we close the year in this issue, could you please tell us how Türk P&I Insurance closed 2023 in terms of innovation and development as well as growth, and what are your targets for 2024 in terms of product range, customer portfolio and investments?

Türk P&I insurance has directed the last 3 years, including 2023, to increase its development towards overseas policyholders. As of 2023, we are selling the Türk P&I brand in 17 different countries. We have become a sought-after and trusted brand among shipowners and marine operators. We can say that premium production from foreign customers accounts for over 60% of our total production. Exporting financial services is an issue we attach great importance to. Türk P&I is no longer a company working strictly for the domestic market. We have started to compete with similar companies in international markets. In 2023, we achieved a production increase of around 30% in USD terms compared to the previous year. In fact, we have a long way to go, considering that the size of the market we are in is over 10 billion USD in total in terms of hull machinery and P&I.

In what ways do the wars and embargoes in our region cause problems for insurers?

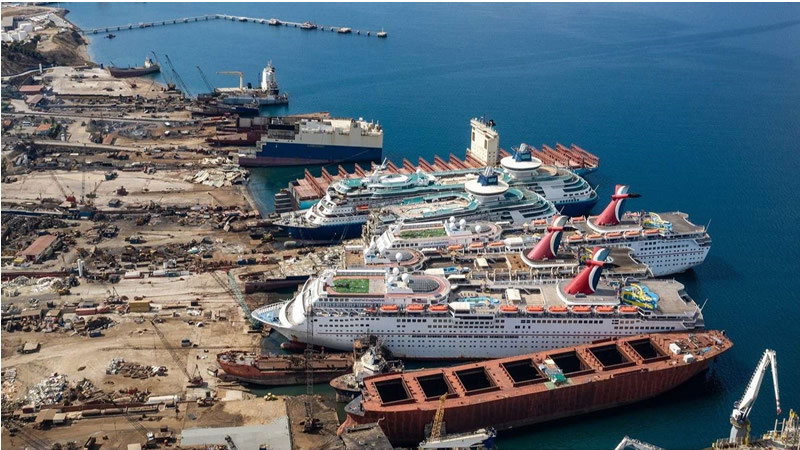

The geography we are in continues to increase its characteristic of being a region where it is difficult to trade and live. In the last two years, the embargo on Iran, Syria, Libya and Russia, together with the Russian-Ukrainian war and the war situation that emerged between Israel and Gaza, have made it almost impossible to carry out commercial activities. While the insurance premiums of the ships sailing to these war zones are increasing, the fact that the ships sailing to the region do not carry out the maintenance that they should carry out leads to damages that should not be encountered. In particular, some shipowners who want to transport Russian-origin oil as indirectly as possible navigate the embargo borders and this causes serious problems for insurers.

The General Directorate of Maritime Affairs made a statement on Twitter and said "Our General Directorate will exempt the ships that will carry these cargoes between the ports of our country from the practice of submitting a Letter of Confirmation regarding the validity of the P&I insurance of the ships passing through the Turkish Straits loaded with crude oil or petroleum products." What are your thoughts on this issue?

As you know, effective December 2022, the International Group Clubs (IG Group Clubs) had announced that ships that did not meet the embargo conditions regarding Russian oil would not have P&I insurance coverage. On the other hand, a tanker traffic was continuing through the Turkish Straits. In this context, the administration announced that it would not pass through the Turkish Straits if the ships could not provide a confirmation letter of P&I insurance. After this application for all tankers, it was not applied for the vessels between two Turkish ports, i.e. non-Russian vessels, which I believe is a very reasonable decision in terms of ease of operation.

And finally, how do you evaluate the acceptance of Türk Loydu to IACS Membership and how do you think it will reflect on our sector?

Türk Loydu is a very important institution for our country. Being included in the International Association of Classification Societies, which is the highest association of institutions invited by shipowners to voluntarily check the physical condition of ships among maritime institutions, means a great deal to us. Among these meanings, earning more income is of course important, but it is at the bottom of the list. Türk Loydu has found a place in the world league, which is perhaps a much higher level than our country, and will pull our maritime industry, our construction sector and our suppliers up. The organization needs to be supported and paved the way in this difficult process. I will try to summarize what needs to be done with a very simple question. Which classification society do Italian flagged ships work with in Italy, which classification societies do shipowners in Scandinavia choose? Countries subject Classification societies and P&I Clubs, which are important institutions for them, to positive discrimination. I hope that this institutional nationalism will reach the desired levels in Turkey.

TURK MARINEWS