2022 Cargo Review

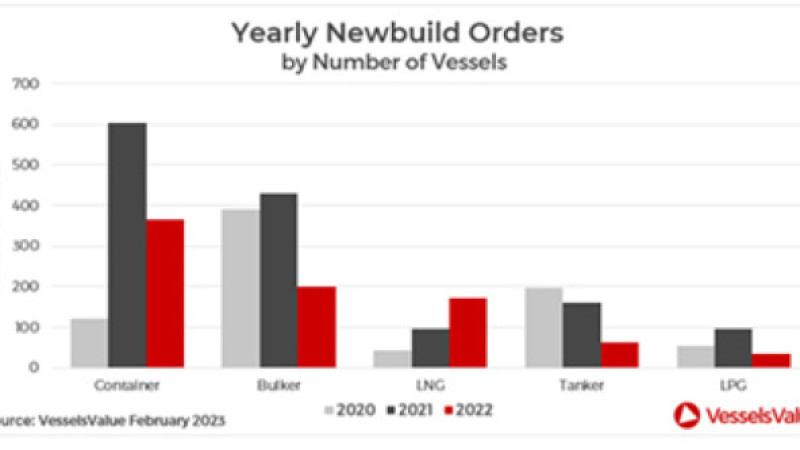

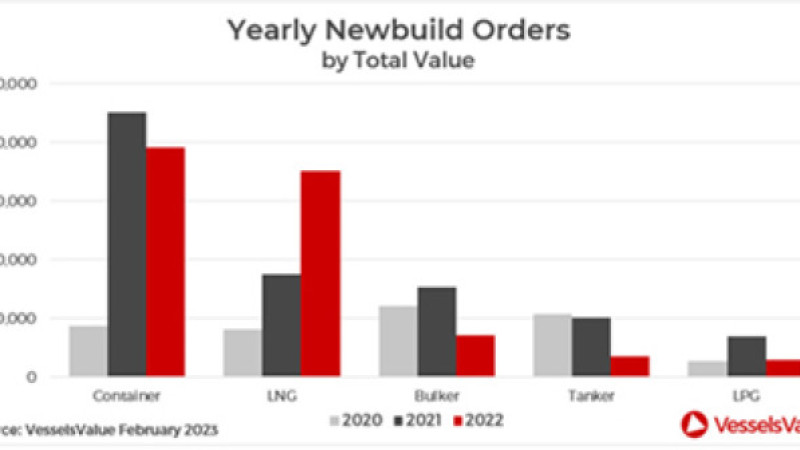

2022 was another strong year for Gas and Container orders. but overall. 2022 orders fell short of the record breaking numbers seen in 2021.

Rebecca Galanopoulos Jones

-The number of newbuilding orders for 2022 reflected global geopolitical concerns. as well as an increasingly prominent green agenda. The shift to cleaner energy sources. energy security concerns. and the conflict between Ukraine and Russia have all contributed to an increase in the number and value of Gas carriers on the orderbook.

The Cargo vessels in this report covers Containers, Bulkers, Tankers and Gas (LNG and LPG).

809 vessels were added to the orderbook in 2022. a c.41% decrease from the 1,383 vessels ordered in 2027. Following the extraordinary growth in the prices of vessels ordered seen in 2021, values tailed off slightly in 2022 falling by c.7.4% to USD 87.9 bn. The 2022 figures cannot compare to the staggering increase of 124% in 2021 but have remained at high levels..

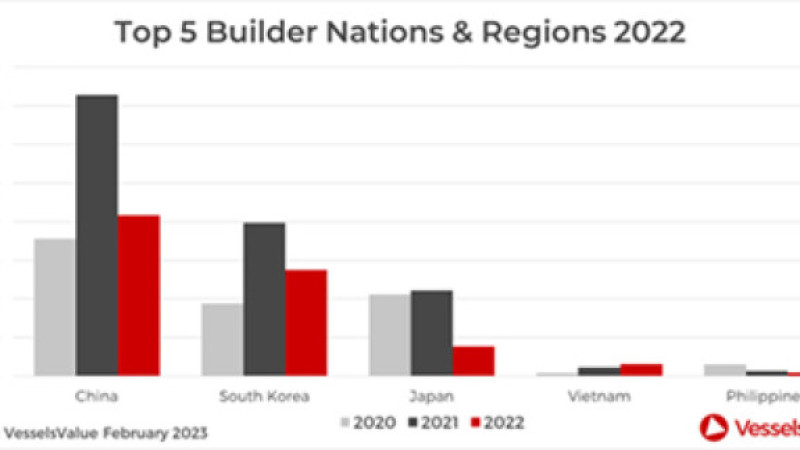

As expected. the large majority of vessels ordered in 2022 are to be constructed in yards in China. South Korea and Japan. The number of vessels confirmed in these three countries totals 769 with 417 in China. 275 in South Korea and 77 in Japan. Other notable builders include Vietnam and the Philippines with 31 and 9 vessels ordered in these countries respectively..

Tankers

Rates reached two year highs during the third quarter of 2022, strengthening values across all Tanker sectors. This meant that the onus was on vessels able to trade immediately, particularly older. more cost effective tonnage. As with Bulkers, Tanker newbuilding slots were harder to come by, with yards preferring to focus on the deluge of higher priced orders in the Container and LNG sectors. spurred by booming earnings in both markets. Furthermore. many owners have decided to wait for more clarity on green regulations from the International Maritime Organization (I MO) before placing new orders. resulting in a significant drop in demand for Tanker newbuildings in comparison to 2027. Low orderbook levels and an ageing fleet. on the other hand. should support Tanker freight rates in the future.

Tanker newbuilding orders fell for the third year in a row from 198 in 2020 to 159 in 2027. Then. just 63 in 2022. a fall of c.60% YoY resulting in a total 2022 orderbook worth USD 3.4 bn, down c.60% from 2027. Despite considerably fewer orders being placed in 2022, Greece remained the biggest spender in this sector. accounting for c.28% of the total. followed by Singapore with c.23% of orders. and Japan ranking third with c.17% of orders.

Headline orders:

• 6. December: 4 Suezmax Tankers (157,000 DWT, 2024-25, Times New Shipbuilding) ordered by TMS Tankers for USD 72 mil each

• 7October: 2 Aframax Tankers (115,000 DWT, 2024, DH Shipbuilding) ordered by Atlas Maritime for USD 64 mil each

• 16. September: 4 MR2 Tankers (50,000 DWT, 2025, Hyundai Vietnam) ordered by Mitsui and Co for USD 42.75 mil each

• 8.July:4 MR2 Tankers (50,000 DWT, 2024, Hyundai Vietnam) ordered by Nissen Kaiun for USD 42.55 mil each

Bulkers

Following on from a very successful year in 2021, 2022 saw a much more moderate market for Bulkers. Despite a strong Q2. earnings began to trend lower in the second half of the year as low demand from China and global economic concerns put pressure on this sector. This sentiment. coupled with shipyard orderbooks already at capacity with high ticket vessels such as Container and Gas newbuildings. translated to a decrease in orders for Bulkers in 2022.

In fact. the number of Bulker newbuild orders placed dropped from 429 in 2021 to 199 in 2022. a fall of 54% YoY, resulting in a total 2022 Bulker orderbook worth USD 7.2 bn, down from USD 15.3 bn in 2021. Chinese owners continued to be the biggest spenders on Bulkers in 2022 with 52 orders placed. followed by Greece who splashed out on a total of 27 orders. Japanese owners came third with 19 new orders.

Compared to previous year's Bulker newbuild activity. there has been a distinct drop in demand in 2022, however this limited supply should bode well to support freight rates in the future.

Headline orders:

• 17. November: 10 Capesize Newcastlemax Bulkers (210,000 DWT, 2025-2026, Qingdao

Beihai Shipbuilding) ordered by Bocimar for USD 64 mil each

• 2. November 2 Post Panamax Bulkers (95,000 DWT, 2025, Oshima) ordered by NYK Line for USD 130 mil en bloc

• 18. March: 4 Handy Bulkers (40,000 DWT, 2024, Jiangsu Daijin Heavy Ind) ordered by

Vogemann for USD 116 mil en bloc

• 26. January: Capesize Newcastlemax Bulkers (210,000 DWT, 2024, Quingdao Beihai

Shipbuilding) ordered by Bocimar for USD 66 mil each

LNG

The LNG sector saw a c.79% increase in vessels ordered YoY from 96 in 2021 to 172 in 2022, totalling USD 31 bn. Despite a marginal increase in Gas orders overall. the value of newbuilding orders in 2022 soared to USO 35 bn, over four times the value of orders placed

in 2020, indicating a significant firming in newbuilding prices. Soaring demand for LNG carriers is being fuelled by a global push towards green energy altern atives. W ith LNG having a smaller carbon footprint compared to traditional hydrocarbons. it is seen as a promising transition energy source.

As a result. newbuilding values for large LNG carriers of 174,000 CBM are up c.26% YoY from USD 205.74 mil to USD 257.78 mil. Some of the main market participants have been MOL. NYK Line. Global Meridian and Knutsen OAS ordering up to 20 vessels each so far this year. However. high steel costs and low yard availability have also led to increased prices for LNG newbuildings this year.

Over the course of 2022, geopolitical uncertainty has also had an impact on demand for Gas carrying vessels. LNG values have continued to strengthen. spurred by skyrocketing earnings that have surpassed last year's record breaking peaks. In November. LNG rates peaked at a record high of 466.524 USD/Day from the Baltic Exchange BLNGlg assessment. pushing up LNG values. Demand for LNG carriers has increased exponentially this year due to the energy crisis in Europe. As a result. the EU is attempting to reduce its reliance on Russian gas. following the conflict with Ukraine. Demand for seaborn e LNG imports has surged as Russia steadily cuts gas flows from pipelines. forcing many countries in Europe to turn to floating storage units.

Japan led the way in terms of 2022 LNG sector investment. knocking Greece from the top spot. They take the lead for LNG orders totalling 44 vessels. worth c.USD 6.5 bn an increase of c.309% YoY in terms of value.

Headline orders:

• 21. December: 2 Large LNG carriers (174,000 CBM, 2026, Hyundai Samho Heavy Ind)

ordered by Asyad Shipping for USD 250.39 mil each

• 10. November: 2 Large LNG carriers (174,000 CBM, 2026, Samsung) ordered by

Minerva Marine for USD 275.49 mil each

• 28. April 6 Large LNG carriers (174,000 CBM, 2025-2026, Hudong Zhonghua) ordered by NYK Link for USD 200 mil each

• 7. January: 6 Large LNG carriers (174,000 CBM, 2024-2026, Hudong Zhonghua)ordered by MOL for USD 796 mil each

LPG

LPG orders fell in 2022 with just 35 new orders places. compared to 97 in 2027. a decline of c.64%. China and Japan both ranked first. both with eight orders placed in 2022. Almost all Chinese orders were in the VLGC sector. whereas Japanese investment was split between VLGCs and the full press sector. Therefore. China led the way in terms of value. doubling their investment YoY to USD 870 mil and knocking South Korea off the top spot.

Almost half of 2022 LPG orders are scheduled to be built in South Korea. accounting for c.46% of orders. China followed second. accounting for c.35% of orders. the remainder of orders were placed in Japanese yards. accounting for c.79%.

Some key market players who have recently placed new orders include. Evalend Shipping who placed five orders for LPG carriers over the course of 2022, all scheduled to be built in South Korea. Exmar placed four new MGC LPG orders to be built in South Korea. and Pacific Gas. who placed four VLEC orders that will be built in China and scheduled for delivery in 2025.

• 30November: 2 VLEC carriers (99,000 CBM, 2025-2026, Hyundai Heavy Ind) ordered by lino Lines for USD 750.77 mil each

• 10. February: 2 VLEC carriers (99,000 CBM, 2025, Jiangnan Shanghai Changxing) ordered by Wanhua Chemical for USD 728 mil each